With the Labor government securing another term, agribusinesses across Australia are once again considering how federal policy decisions will shape operations, investment and growth. But amid the economic outlooks and supply chain forecasts, there’s one area of business that’s often overlooked yet crucial to future success – marketing.

From shifting climate policy to workforce reform, the actions of Labor will have a tangible impact on how agribusinesses position themselves, engage customers and future-proof their brands.

Here are the key areas where we expect change, and what that means for marketing strategy across the agricultural sector.

- Climate policy and sustainability credentials will no longer be optional

Labor’s continued commitment to net zero by 2050 and the Safeguard Mechanism reforms mean emission targets are front and centre, particularly for large-scale producers and processors. For agribusinesses, this creates both a pressure point and an opportunity.

Marketing implications

- Strong sustainability messaging will become a must-have, not a nice-to-have.

- Third-party certification, traceability systems, and ESG reporting will become essential content pillars across brand, digital and investor communications.

- Businesses seen to be proactive, transparent and practical in their sustainability journey will gain brand trust – especially with retailers and export partners.

- Skilled migration and workforce reform will reshape brand perception

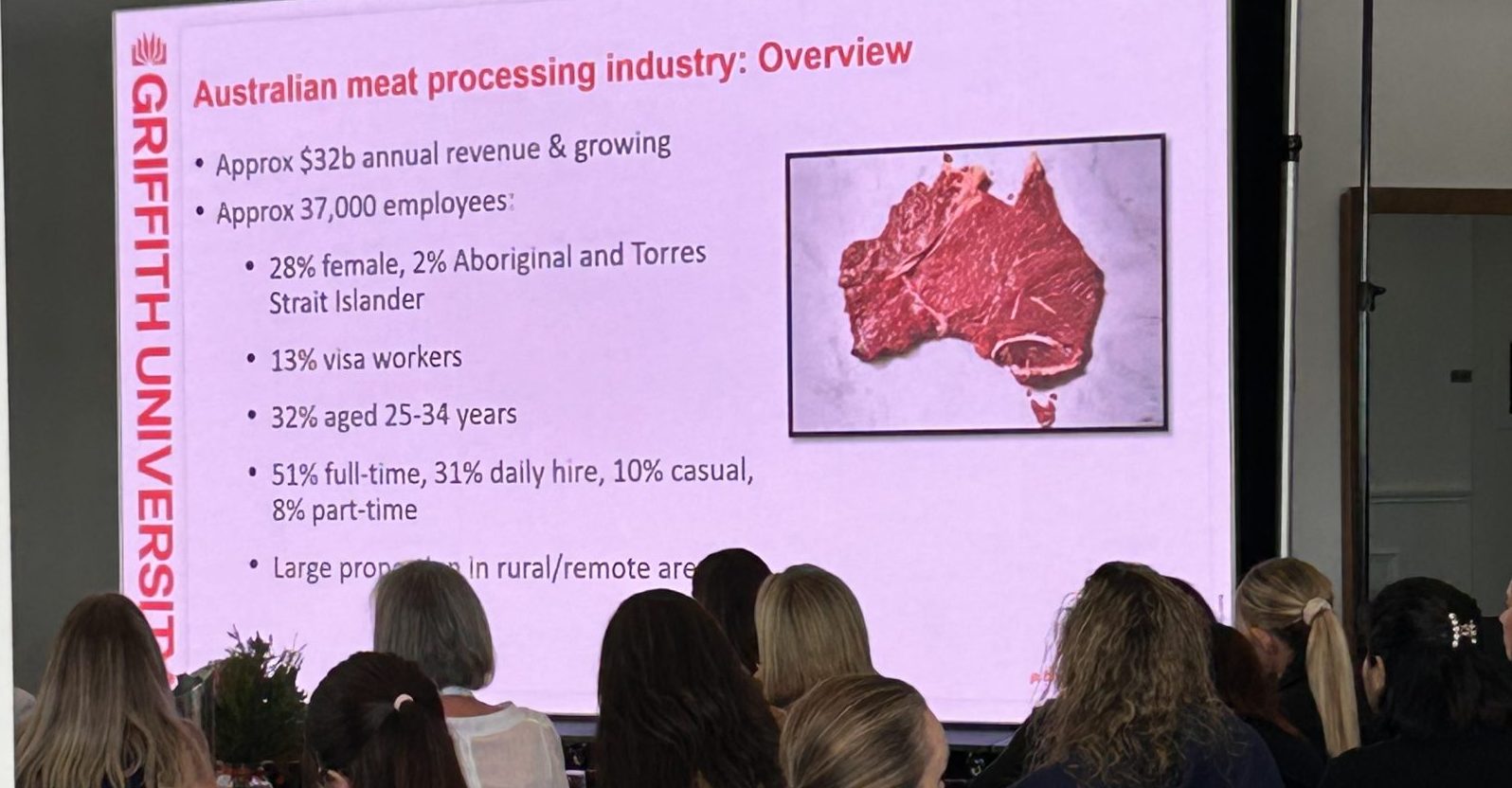

Labour shortages remain a pain point for Australian agriculture. Labor’s renewed push for regional workforce programs, skilled migration and tighter worker protections (via Fair Work reforms) puts the spotlight on how agribusinesses attract and retain people.

Marketing implications

- Employer branding will rise in importance – businesses must articulate why people should work for them.

- Transparency around pay, safety, training and working conditions will influence both candidate attraction and consumer trust.

- Authentic storytelling – particularly in social media content and video – will help demystify roles and regions, especially for international or urban audiences.

- Regional infrastructure funding means more opportunity – but also more competition

With billions allocated to regional transport, digital connectivity and energy projects, agribusinesses have new tools to scale, access markets faster and adopt new technologies. But with these advantages comes increased competition – especially in high-value export sectors like beef, grain and horticulture.

Marketing implications

- Brands will need to be razor-sharp in articulating their value proposition, particularly in competitive global markets.

- First movers in tech adoption (e.g. smart irrigation, autonomous equipment and carbon measurement tools) will benefit from being seen as leaders – so long as they communicate it clearly.

- Place-based branding (e.g. provenance, terroir and unique microclimates) will become more powerful as regional brands grow.

- Biosecurity and food security are now public issues, not just farmgate ones

Increased government focus on national biosecurity and food system resilience means consumers and policymakers are paying more attention to where food comes from and how it’s protected.

Marketing implications:

- Crisis communication plans and reputational risk strategies should be revisited and solidified.

- Education-led content – eg explaining what biosecurity protocols are and why they matter – will help businesses take control of their narrative.

- Opportunities exist for B2B partnerships that highlight supply-chain resilience as a selling point.

Final thought

A re-elected Labor government brings continuity in policy direction, but also an accelerated pace of change. For agribusinesses, the winners will be those who treat marketing not as a surface-level tactic, but as a strategic lever for trust, growth and talent.

At Sketch Corp, we help agribusinesses align brand, content and digital with the forces shaping agriculture’s future. Want to talk about how these shifts affect your brand? Let’s talk.